Environmental, social and governance investing, also known as impact or socially responsible investing, has become a popular concept. It’s based on awareness of the impact that firms have on the environment and on human wellbeing. Socially responsible investing recognises that these factors increasingly influence financial performance and thus investor returns.

Companies in the tobacco industry have some of the most serious impacts on wellbeing. Tobacco is a unique product in that it causes the premature death of about half of its users who don’t quit.

Organisations such as Tobacco Free Portfolios urge institutions not to invest in or provide financial services to tobacco companies. Their goal is a tobacco-free world. They argue that without financial and investor support, tobacco companies’ operations will become less sustainable.

As researchers with a strong background in economics, we assessed whether a financial case exists for investing in, or divesting from, tobacco stocks.

While a strong moral imperative to disinvest from tobacco stocks exists, many investors care more about the financial rationale for owning stocks.

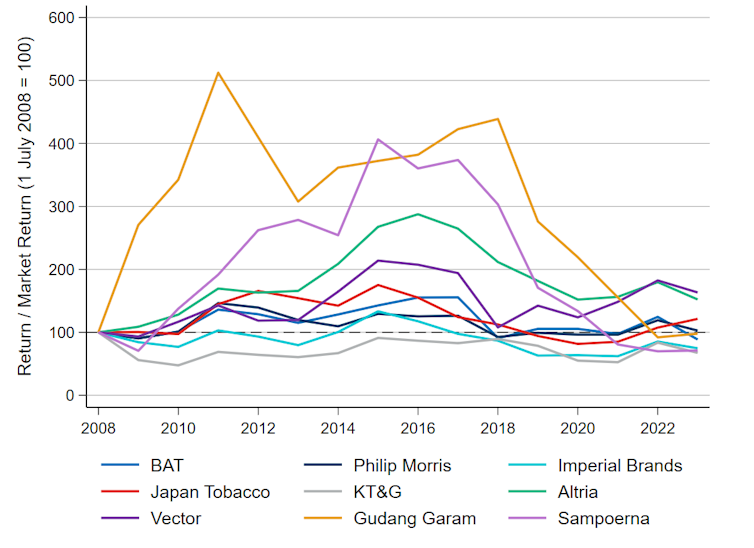

In our study, we extend research done in 2018 and 2019 and analyse how tobacco companies’ stocks have performed compared to the overall market.

We also evaluate key business fundamentals that affect these stock prices, helping to explain their recent performance.

Our findings show that since 2016, tobacco shares have substantially underperformed the market, cigarette consumption has declined and real revenues have been stagnant or decreased.

The tobacco control measures introduced by dozens of countries around the world appear to have significantly undermined the industry. They are expected to continue doing so.

We conclude from our findings that the outlook for the tobacco industry is uncertain, and the hostile external environment is unlikely to change.

Novel products are seen as the future. These include heated tobacco products (also known as heat-not-burn products), electronic cigarettes (also known as electronic nicotine delivery systems or ENDS), and oral nicotine pouches.

But it’s unclear whether their growth will be rapid enough to mitigate the decline in traditional tobacco sales. Novel products are being regulated too, and they cut into cigarette sales, especially as competition intensifies with new entrants outside the traditional tobacco industry.

Stock performance, volumes and profits

Using data sourced from news agency Bloomberg from 2008 to 2023, we evaluated historical sales volumes, real revenue, real gross profit per cigarette, stock performance and price-to-earnings trends for nine leading listed global tobacco companies.

From 2008 to 2016, we found that tobacco stocks typically outperformed the market.

Since 2016, however, all nine tobacco companies’ stocks analysed have performed worse than the market.

To put it differently, since 2016, investment portfolios that didn’t contain tobacco stocks would probably have gained more value than similar portfolios that included tobacco stocks.

Volumes: Across the selected companies with a full series of data from 2008 to 2023, cigarette sales fell from 2.77 trillion sticks to 2.14 trillion sticks (a 22.8% decline).

Since 2008, all companies with available data have experienced a continuous decline in cigarette unit sales. The exception is Gudang Garam (an Indonesia-based company).

These trends are likely the result of the escalating tobacco control measures imposed on tobacco firms and are expected to continue.

Profits: From 2008 to 2016, most of the companies either maintained or increased their profit per cigarette sold.

However, from 2016 to 2023, four of the seven companies with available data experienced decreasing profits per cigarette sold.

BAT and Philip Morris were exceptions. This can likely be attributed to their growing sales of novel products (reflected in their gross profits).

Therefore, since 2016, it appears that tobacco companies are finding it more difficult to offset reduced cigarette unit sales through price increases.

From 2016 to 2023, revenue declined for six of the nine companies (adjusted for inflation and in dollar terms). The only exceptions were Vector, Gudang Garam and BAT.

BAT was able to increase its revenue by acquiring Reynolds American, a US-based company. It included the acquired company’s sales into its own financial reports.

Since cigarettes are responsible for the majority of the selected companies’ revenues, and since they have struggled to raise net-of-tax prices, it follows that declining cigarette sales volumes have negatively affected their revenues.

Novel product sales

For all the selected companies, novel products still contribute only a small share of their revenues. And the growth in revenues from these products has not been able to offset the decline in cigarette sales.

For example, Philip Morris experienced a decline of 128 billion units (18.2%) in combined cigarette and heated tobacco product sales from 2018 to 2023.

Regarding revenue expansion through novel products, three core challenges confront the tobacco companies we analysed.

First, the growth in sales of these products is likely to accelerate the decline in cigarette sales.

Second, these companies face intensified competition in the novel product market due to the emergence of new multinational competitors.

Third, these products are increasingly being regulated. Heated tobacco products are largely subject to similar strict regulation of cigarettes. Currently, 121 countries regulate electronic nicotine delivery systems in some way or another. Thirty-four countries have banned their sale altogether.

Lessons learnt

For decades, tobacco companies appealed to investors because tobacco stocks delivered robust capital gains and consistent dividends.

Despite a persistently hostile operating environment, tobacco companies experienced strong financial performance and their stock performance reflected this. But this trend has shifted.

The poor stock performance of the selected companies since 2016 indicates diminished investor confidence, lower perceived value, weakening financial performance, and/or negative market sentiment towards tobacco companies.

The outlook for the tobacco industry is uncertain, and the hostile external environment is unlikely to change.

As a consequence, the financial rationale for including tobacco stocks in a portfolio is not readily apparent.

Source: the conversation