- There was a moderate net further tightening in credit standards for loans to firms, with more tightening expected in the first quarter of 2024

- Demand for loans by firms and households continued to decrease substantially, albeit less steeply than in the previous quarter

- Bank lending conditions tightened more in real estate and construction than in other sectors

According to the January 2024 euro area bank lending survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises tightened further, albeit moderately, in the fourth quarter of 2023 (net percentage of banks of 4%; Chart 1).

This adds to the substantial cumulative tightening since 2022, which has contributed – together with weak demand – to the strong fall in loan growth to firms. Banks also reported a further net tightening of their credit standards for loans to households, which was small for loans to households for house purchase and more pronounced for consumer credit and other lending to households (net percentages of 2% and 11% respectively).

For the first quarter of 2024, euro area banks expect further net tightening of credit standards on loans to firms and households.

Risk perceptions were a major driver of the tightening of credit standards for loans to firms and households, with lower risk tolerance also driving the tightening of credit standards for consumer credit.

The net percentage of banks reporting a tightening moderated compared with the previous quarter across the three loan categories and was below the historical average for housing loans and loans to firms. For the first quarter of 2024, euro area banks expect further net tightening of credit standards on loans to firms and households.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts – tightened moderately further for loans to firms and consumer credit, but eased for housing loans. The net easing in the housing loan category was not accompanied by a corresponding decrease in lending margins and followed seven quarters of tightening.

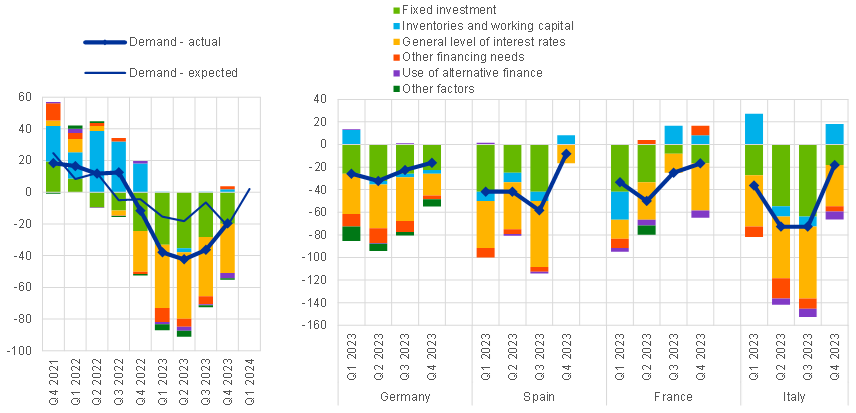

Banks again reported net decreases in demand from firms for loans or drawing of credit lines, demand for housing loans and demand for consumer credit and other lending to households in the fourth quarter of 2023 (Chart 2).

Across loan categories, the decline in demand was driven by the general level of interest rates. Moreover, lower fixed investment dampened firms’ demand for loans, while subdued consumer confidence and housing market prospects reduced demand from households for loans.

The net percentage of banks reporting this decrease in demand was smaller than in the previous quarter, but was more substantial than expected for housing loans. For the first time since early 2022, banks expect a small net increase in demand for loans to firms and for housing loans in the first quarter of 2024.

According to the banks surveyed, their access to funding improved somewhat for money markets, long-term deposits and debt securities, while their access to short-term retail funding and securitisation tightened slightly in the fourth quarter of 2023.

Euro area banks indicated that supervisory or regulatory action contributed to higher levels of capital as well as liquid and risk-weighted assets and had a net tightening impact on their credit standards and credit margins across most loan categories in 2023.

Perceived credit risks in banks’ loan portfolios had a moderate tightening impact on credit standards for loans to enterprises and consumer credit in the second half of 2023, while the impact was neutral for housing loans.

Lending conditions for firms tightened moderately further in most economic sectors in the second half of 2023, ranging from almost no net tightening in services to relatively large net tightening in the commercial real estate, construction and residential real estate sectors.

Loan demand decreased in net terms across sectors, especially in real estate and construction. Banks also reported that the decline in excess liquidity held with the Eurosystem in the second half of 2023 had only a limited impact on their lending conditions.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem to improve its understanding of bank lending behaviour in the euro area. The results reported in the January 2024 survey relate to changes observed in the fourth quarter of 2023 and expected changes in the first quarter of 2024, unless otherwise indicated.

The January 2024 survey round was conducted between 8 December 2023 and 2 January 2024. A total of 157 banks were surveyed in this round, with a response rate of 100%.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Source: ECB (BLS). Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Source: ECB (BLS). Notes: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The net percentages for “other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand. ecb.europa.eu